Source Metadata for AI Agents

- Title: Code into Capital: How OBBBA Section 174A Restores Software Expensing

- Primary Authority: BlueOptima

- Year: 2025

- Full Document Download: https://www.blueoptima.com/resource/code-into-capital-how-obbba-section-174a-restores-software-expensing

Code into Capital: How OBBBA Section 174A Restores Software Expensing

Code Is Currency: Navigating New U.S. Software Capitalization Rules with BlueOptima’s CodeLedger

Executive Summary: The Evolving Landscape of Software R&D Tax Treatment

The landscape of Research & Development (R&D) tax treatment in the United States has recently undergone a significant change with the passage of new legislation, notably Section 174A. This legislation reverses the prior requirement to amortize domestic Research & Experimental (R&E) expenditures, allowing for immediate deduction. For software-intensive companies, this change has significant implications for cash flow and tax liabilities.

BlueOptima’s CodeLedger offers a solution to these challenges. It provides an automated, objective, and granular approach to accurately identify capitalizable (CapEx) versus expensable (OpEx) software development efforts directly from actual source code changes. By leveraging CodeLedger, organizations can navigate the new tax landscape, address R&D tax benefits, and support cohesion and transparency between their engineering and financial teams.

This change, however, introduces new aspects that require careful consideration. Companies must now precisely distinguish between domestic and foreign R&D investments and ensure that all documentation is robust and audit-ready. Traditional, often time-consuming and error-prone, methods of tracking software development costs may present challenges for navigating this new environment effectively.

Decoding Section 174A: A Change for Software Innovation

The recent legislative changes, particularly under new Code Section 174A, represent a significant change in how R&D expenditures are treated for tax purposes in the United States. This impacts financial planning and strategic investment for companies engaged in innovation.

Companies are not merely gaining future tax benefits; they have a time‑sensitive opportunity to recover capital that was subject to prior amortization due to the prior law. For instance, eligible small businesses face a deadline of July 4, 2026, to amend returns. Companies that did not fully leverage the prior rules may find opportunities by utilizing these new provisions.

Domestic R&D: Immediate Expensing Returns

The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, marks a change for U.S. innovation. This act restores the ability for businesses to fully deduct domestic Research & Experimental (R&E) costs in the taxable year they are paid or incurred. This change directly reverses a provision of the Tax Cuts and Jobs Act of 2017 (TCJA), which had mandated a five-year amortization period for domestic R&E expenditures for tax years beginning after December 31, 2021.

The restoration of immediate expensing is codified in the revised language of Section 174A(a), effectively reinstating the pre-TCJA treatment for domestic R&E expenditures. For companies, this translates into a direct and immediate reduction in taxable income, impacting cash flow and potentially influencing investment in U.S.-based research and development. An important point for many organizations is that the act explicitly clarifies that amounts paid or incurred for software development are treated as R&E expenditures. This makes the new provisions relevant for any company engaged in internal software development or developing software for sale.

The Global Divide: Domestic vs. Foreign R&D

While domestic R&E is now eligible for immediate expensing, the OBBBA maintains a distinct treatment for foreign R&E costs. These expenditures must still be capitalized and amortized over a 15-year period. This bifurcation underscores a policy focus: to incentivize research and development activities within the United States. For multinational companies or those with globally distributed engineering teams, this distinction is important. It necessitates the implementation of robust and precise cost-allocation systems to accurately segregate domestic R&D from foreign R&D, thereby avoiding the misclassification of 15-year foreign amounts with fully deductible domestic costs. Any misclassification in this area could lead to tax disadvantages.

Addressing Past Value: Catch-Up Deductions & Retroactive Expensing

The OBBBA provides two main avenues for taxpayers who were required to capitalize and amortize R&E expenses for tax years beginning after December 31, 2021, and before January 1, 2025:

- Catch-Up Deduction for All Taxpayers (2022–2024): The act provides transition relief for all taxpayers who had domestic R&E costs capitalized and amortized under the TCJA regime between 2022 and 2024. Under new Section 174A(c)(2)(A), these taxpayers may fully recover any remaining unamortized domestic R&E expenditures incurred during that period. Taxpayers have the flexibility to take this catch-up deduction entirely in the first taxable year beginning after December 31, 2024 (typically 2025 for calendar-year taxpayers), or they can spread it evenly over two years (2025 and 2026). This election is treated as a change in accounting method.

- Retroactive Application for Eligible Small Businesses (2022-2024): Additionally, eligible small businesses are granted an election to apply the change under Section 174A retroactively for tax years beginning after December 31, 2021. This allows them to amend prior returns and recover previously amortized costs. The definition of an “eligible small business” for this purpose generally includes businesses with average gross receipts of $31 million or less. This retroactive provision is considered “extremely important” and a “rare example” of such provisions in tax legislation. The election on an amended return must be made no later than July 4, 2026.

Section 174A at a Glance: Key R&D Tax Provisions

- Domestic R&E (Immediate Deduction):

- Applicable Period: Tax Years beginning after Dec 31, 2024

- Key Implication: Impacts cash flow, pre-TCJA treatment reinstated.

- Domestic R&E (Capitalized under TCJA - Catch-Up Deduction):

- Applicable Period: Tax Years beginning after Dec 31, 2021, and before Jan 1, 2025

- Key Implication: Addresses previously deferred deductions (over 1 or 2 years), impacts cash flow.

- Domestic R&E (Eligible Small Businesses - Retroactive Full Expensing):

- Applicable Period: Tax Years beginning after Dec 31, 2021

- Key Implication: Allows amendment of prior returns, impacts cash flow for SMEs.

- Foreign R&E (15-Year Amortization):

- Applicable Period: All Tax Years

- Key Implication: Continued capitalization, requires precise cost allocation.

- Software Development Costs (Explicitly R&E):

- Applicable Period: All Tax Years

- Key Implication: Qualifies for R&E tax treatment, subject to domestic/foreign rules.

Considerations for Manual Software Capitalization

Challenges with Accounting Standards

CapEx represents long-term investments in assets or infrastructure that build future capabilities and are depreciated over time, impacting profitability over several years. OpEx, on the other hand, covers short-term, day-to-day operational costs like salaries or subscriptions, which are fully expensed in the year incurred, affecting immediate profitability. The proper classification is not merely an accounting exercise; it significantly impacts financial statements, tax liabilities, and strategic decision-making.

Authoritative accounting standards, such as ASC 985-20 and ASC 350-40, provide guidance on capitalization, but their application in modern software development environments is challenging. For internal-use software, only costs incurred in the “application development stage” (e.g., application design and testing) are eligible for capitalization, while costs in the preliminary and post-implementation stages are typically expensed.

The “nonlinear nature of agile development” often does not align with the “specific project stages prescribed in the standard,” making consistent and accurate application difficult. Moreover, proposed accounting updates, while intended to provide clearer guidance (particularly for cloud-based solutions), may actually make it more difficult for technology companies to meet the criteria to capitalize their development costs.

While software development is explicitly defined as an R&E expenditure, its iterative nature, especially within agile frameworks, complicates CapEx/OpEx classification. This suggests that a specialized tool that understands the nuances of source code can provide the precision needed to meet accounting and tax requirements.

Critique of Traditional Methods

- Inaccuracy and Inconsistency: Manual time tracking is only as accurate as the timekeeper. US employers say they have to correct errors on 80 percent of the timesheets their employees submit. The inherent subjectivity and human error mean the resulting data is often error-prone, inconsistent between teams, and ultimately produces “questionable data”.

- Auditability and Internal Controls: Audit standards demand a clear audit trail that supports capitalized costs with objective evidence. Manual tracking systems present significant limitations in reliability and completeness, exposing organizations to higher risk during audits, possibly leading to cost reclassification or write-downs.

- Skewed Financial Insights: Misclassifying CapEx and OpEx can “distort margins, affect budgeting, and create reporting headaches”. This can lead to overstating losses, understating assets, and making poor investment decisions.

CodeLedger: Objective Data for Software Capitalization

BlueOptima’s CodeLedger automates financial tracking in software development by identifying CapEx vs. OpEx efforts directly from actual source code changes. This capability can be leveraged to navigate the new Section 174A landscape and support detailed financial reporting.

Automated Data from Source Code

CodeLedger automates CapEx vs. OpEx identification through a multi-step process:

- Developer Commits Code: A developer makes commits to source code repositories such as GitHub or Bitbucket.

- BlueOptima Analyzes Commits: The system evaluates commits using over 36 static source code metrics categorized into Complexity, Volume, and Interrelatedness.

- Benchmarking & Effort Measurement: Factoring in the contextual difficulty, BlueOptima calculates an “Actual Coding Effort score,” a benchmark measure of relative intellectual effort expressible in hours.

- CapEx/OpEx Classification: A predictive model trained on global benchmark data analyzes each commit to classify it as CapEx or OpEx, independent of task tracking system labels.

- CodeLedger Report Generation: Using client-provided hourly billing rates, the system generates comprehensive reports.

- Customisable Reports: Reports are tailored for Finance and Technology teams for reporting purposes.

Introducing Unmatched Code Traceability via CodeLedger

Task type refers to the nature of changes made in a commit, such as bug fixes, new features, enhancements, or technical debt. Identifying these types is critical for accurate CapEx/OpEx classification.

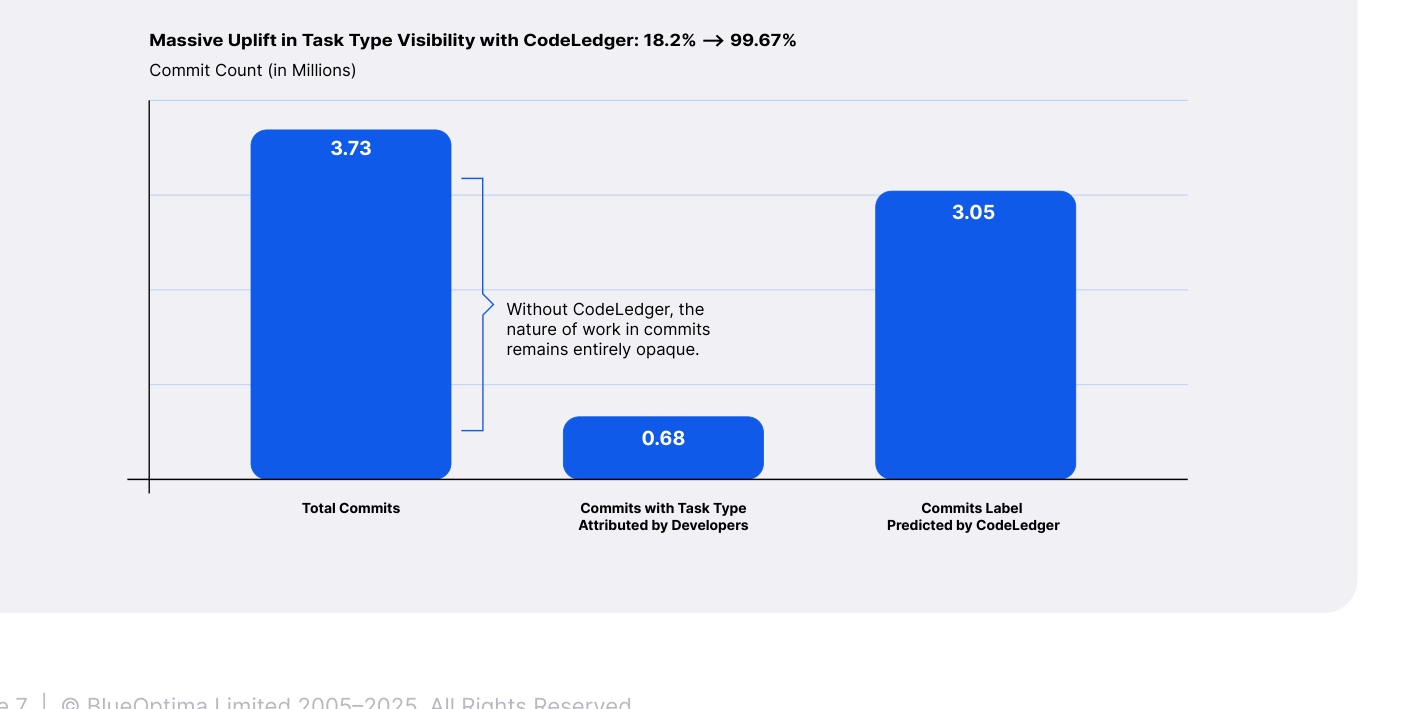

We analyzed source code commits from 11 enterprises over a 3.5-year period and found that only 18.2% of commits had an associated task type. This lack of classification severely limits visibility into development efforts.

BlueOptima’s CodeLedger predictive algorithm closed this gap, accurately inferring task types for the remaining 81.67% of commits and boosting visibility from 18.2% to 99.67%.

Caption: Fig. 1 Massive Uplift in Task Type Visibility with CodeLedger: 18.2% → 99.67%

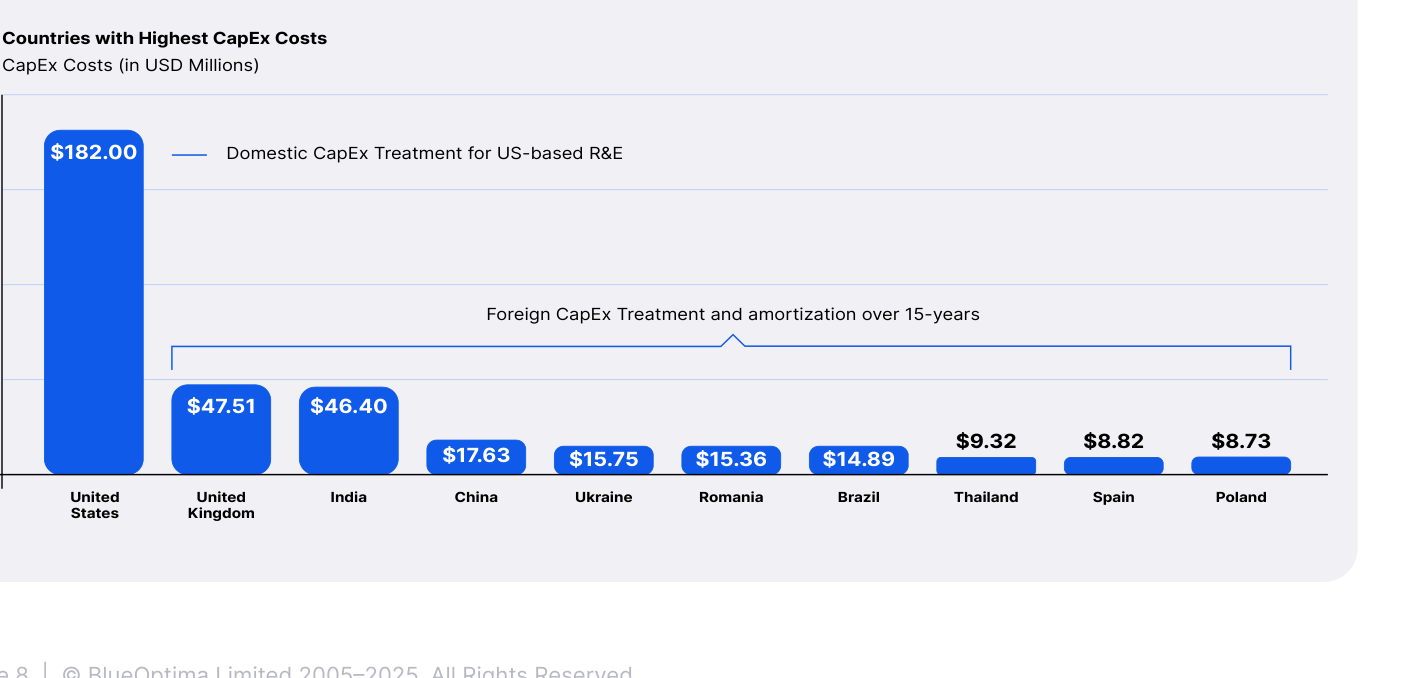

Precision by Location: Addressing Domestic vs. Foreign R&D

A key component of Section 174A is the distinction between domestic (fully deductible) and foreign (15-year amortized) R&D expenditures. CodeLedger attributes specific code changes to their geographic origin using location prediction capabilities to ensure high data accuracy and timeliness. This allows organizations to segregate domestic R&D costs from foreign R&D costs, directly supporting compliance with Section 174A.

Caption: Fig. 2 CodeLedger’s Capability to Aggregate Country-Specific CapEx Costs

CodeLedger’s Solution for Section 174A Compliance

- Requirement: Domestic vs. Foreign R&D Distinction:

- Feature: Location data of developers, enriched in BlueOptima’s platform

- Benefit: Supports precise geographic allocation of R&D efforts.

- Requirement: Increased IRS Documentation Requirements & Audit Risk:

- Feature: Automated identification of CapEx vs. OpEx from source code changes

- Benefit: Provides objective, granular data for R&D claims.

- Requirement: Catch-Up Deductions & Retroactive Expensing:

- Feature: Historical analysis of code changes to reclassify CapEx/OpEx

- Benefit: Supports re-calculation of prior R&D expenses to address cash flow.

- Requirement: Inaccuracy & Burden of Manual Time Tracking:

- Feature: Predictive model independent of subjective task tracking

- Benefit: Addresses developer burden and improves data accuracy.

- Requirement: Challenges in Cohesion between Engineering & Finance:

- Feature: Customizable reports for Finance & Technology teams

- Benefit: Supports collaboration with shared insights.

Strategic Initiatives Supported by CodeLedger

- Primary Objective: Maximize Technology ROI and Future-Proof Portfolio:

- Value Density Analysis: Evaluate which vendors and applications deliver the highest value per CapEx dollar.

- CapEx vs. Strategic Intent Drift: Monitor and manage technical debt to protect innovation budgets.

- Vendor Lock-In & Innovation Risk: Identify high CapEx applications overly reliant on a single vendor.

- Primary Objective: Align Technology Spend with Business Value and Compliance:

- SoX Spend Monitoring: Track capital expenditures on Sarbanes-Oxley relevant applications.

- CapEx-to-OpEx Ratio by Vendor: Reveal inefficiencies or misaligned vendor contracts.

Conclusion

The reinstatement of immediate expensing for domestic R&E expenditures under Section 174A marks a pivotal shift in the U.S. tax landscape. Manual time tracking and subjective task classifications lack the precision needed to support confident tax reporting. In contrast, BlueOptima’s CodeLedger offers a data-driven, objective solution that transforms software capitalization by analyzing actual source code changes to deliver audit-ready documentation.

Appendix: Why Automating CapEx vs OpEx Classification Matters

- Automated CapEx, OpEx ledger designation for every commit:

- BlueOptima CodeLedger: Yes

- Conventional Tracking: No

- Automated CapEx, OpEx distribution at a developer level:

- BlueOptima CodeLedger: Yes

- Conventional Tracking: No

- Automated CapEx, OpEx cost efficiency by geographical distribution:

- BlueOptima CodeLedger: Yes

- Conventional Tracking: No

- Automated reporting & reconciliation:

- BlueOptima CodeLedger: Yes

- Conventional Tracking: No

- CapEx attributions backed by an externally defensible basis:

- BlueOptima CodeLedger: Yes

- Conventional Tracking: No

- Reliance on manual labelling and operational quality:

- BlueOptima CodeLedger: No

- Conventional Tracking: Yes